7 Best Receipt Scanner Apps for Small Business in 2025

Explore the top 7 receipt scanner apps of 2025 that streamline financial management for small businesses with AI-powered features.

Managing receipts can be a hassle for small businesses, but the right scanner app can save time, money, and effort. In 2025, these tools use AI and OCR to achieve up to 99% accuracy, automate workflows, and integrate with accounting software. Here's a quick look at the 7 best receipt scanner apps to simplify your financial management:

- ReceiptsAI: AI-powered categorization with 99% OCR accuracy; starts at $12/month.

- Expensify: SmartScan tech and real-time policy checks; plans from $5/user/month.

- QuickBooks Self-Employed: Tailored for freelancers with TurboTax integration; starts at $15/month.

- Zoho Expense: Multilingual support and integrations; free tier available.

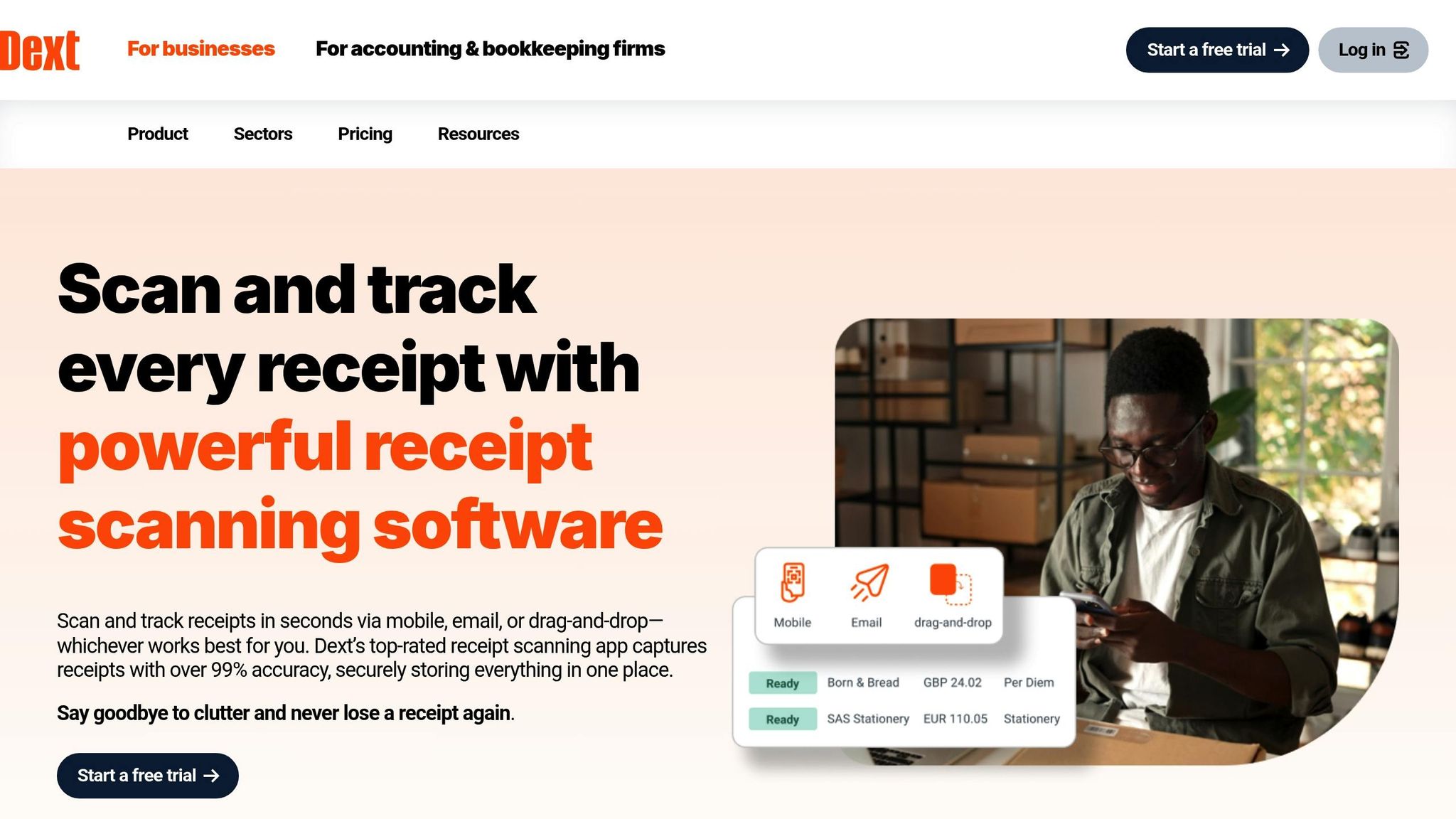

- Dext Prepare: Bulk processing and strong audit trail tools; starts at $20/month.

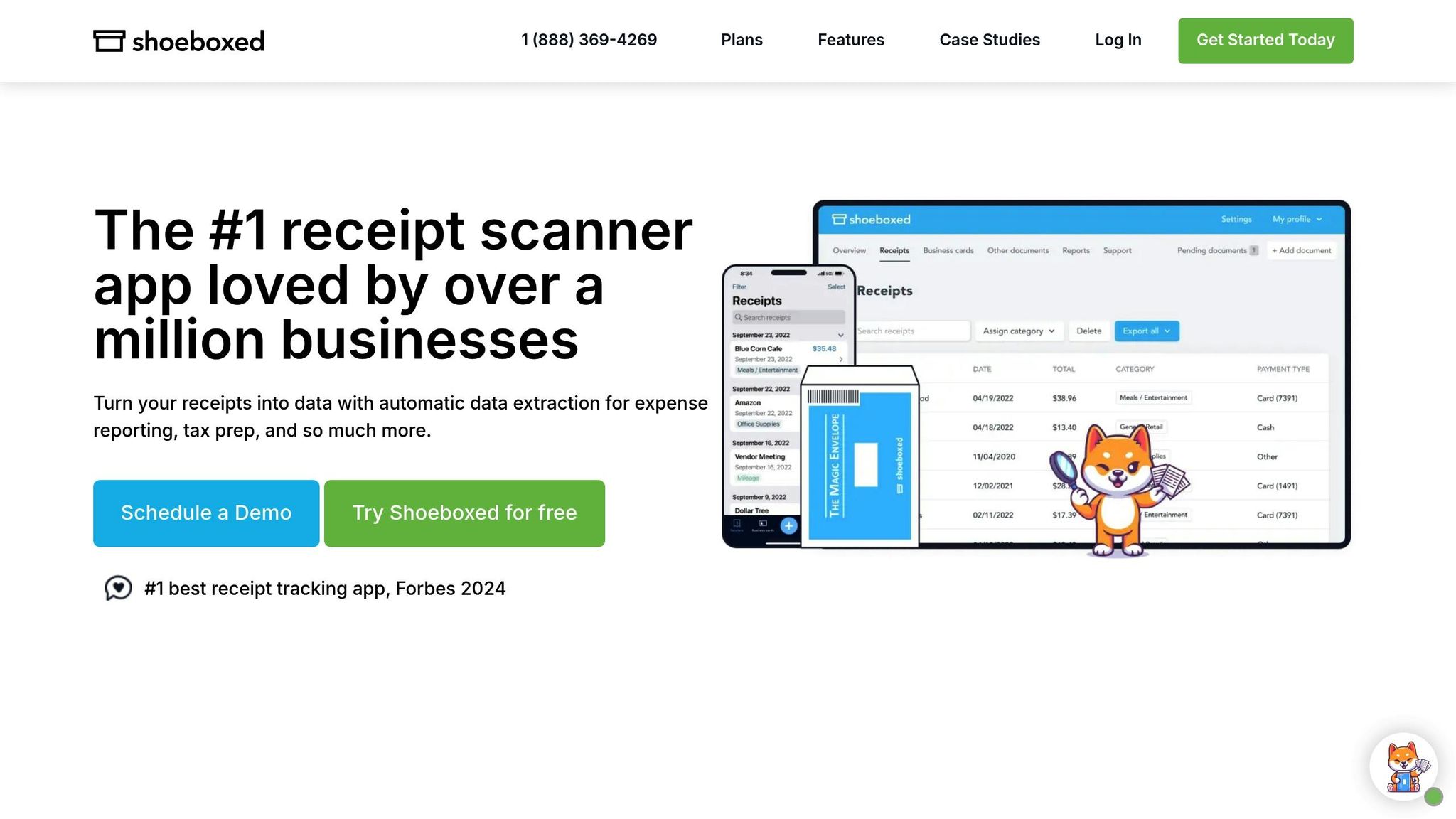

- Shoeboxed: Includes mail-in service for digitizing paper receipts; plans from $18/month.

- Ramp: Free unlimited receipt scanning with advanced features for businesses.

Quick Comparison:

| Feature | ReceiptsAI | Expensify | QuickBooks | Zoho Expense | Dext Prepare | Shoeboxed | Ramp |

|---|---|---|---|---|---|---|---|

| OCR Accuracy | 99% | 99% | High | 90%+ | High | 94% | 98% |

| Free Tier | Yes | No | No | Yes | No | No | Yes |

| Multi-Currency | Yes | Yes | Yes | Yes | Yes | Limited | Yes |

| Pricing (Starting) | Free | $5/user | $15/month | Free | $20/month | $18/month | Free |

Whether you're a freelancer, small business, or global operation, these apps offer tailored solutions to streamline your expense tracking, tax management, and audit readiness. Let's dive into the details of each tool.

Best Receipt Scanner Apps For Small Businesses

Benefits of Digital Receipt Management

Automated workflows cut down on manual errors and speed up processing, making it essential to choose the right features when selecting a solution.

Digital systems ensure IRS-required audit trails are preserved indefinitely with timestamped metadata. Unlike physical receipts, where 40% become unreadable within 2 years, digital storage guarantees businesses can confidently support deductions during tax audits.

Real-time expense tracking allows businesses to spot unnecessary spending 2-3 months earlier than traditional methods, enabling faster corrective actions.

Switching to digital systems also reduces paper waste. For instance, a small business can save 15-20 pounds of paper annually by going digital.

Security is another key advantage. Features like bank-level encryption and role-based access controls protect sensitive financial data. Top providers also adhere to SOC 2 Type II standards.

Integration with platforms like QuickBooks, Xero, and Zoho eliminates duplicate entries, handles multi-currency transactions, and automates VAT/GST detection.

Mobile-first designs make these tools ideal for remote work. With GPS-tagged receipts and real-time sync, employees can submit expenses instantly from anywhere. These mobile features are particularly useful for distributed teams using the apps we discuss.

Must-Have Receipt Scanner Features

To get the most out of your receipt scanner, look for apps that offer these essential features:

High-Accuracy OCR Technology is a must. The app should accurately extract data from receipts, with at least 95% accuracy being the standard. All the apps we recommend meet this requirement.

Accounting Software Integration is key for seamless expense management. Look for apps that connect directly with popular platforms like QuickBooks, Xero, or Zoho Books. This eliminates manual data entry and speeds up processes like month-end closing. For example, Ramp users report completing month-end tasks 22% faster thanks to real-time QuickBooks syncing.

Mobile Functionality is critical, especially since 78% of small business owners handle expenses on their smartphones. Features like in-app camera capture, offline mode, real-time syncing, and cloud backups are non-negotiable.

Automated Workflows save time by streamlining expense reporting. AI-powered tools can reduce the time spent on each receipt from 20 minutes to under 2 minutes. Look for features like smart categorization, batch processing, and export options ready for tax season.

Multi-Currency Support is vital for businesses operating globally. Advanced apps handle over 50 currencies, removing the need for manual currency conversions and simplifying international expense tracking.

Enterprise-Grade Security ensures your financial data stays safe. Features like AES-256 encryption, role-based access controls, and compliance with GDPR/CCPA standards are essential for business-grade apps.

Flexible Export Options make it easier to collaborate with your accounting team. Prioritize apps that support CSV, PDF, and Excel exports for compatibility.

Cost-Effective Pricing should match your business needs. Options range from $5/month for individual users to $36/user for teams, so choose a plan that fits your budget and scale.

These features will help you identify the best app for your needs as we review the top seven options below.

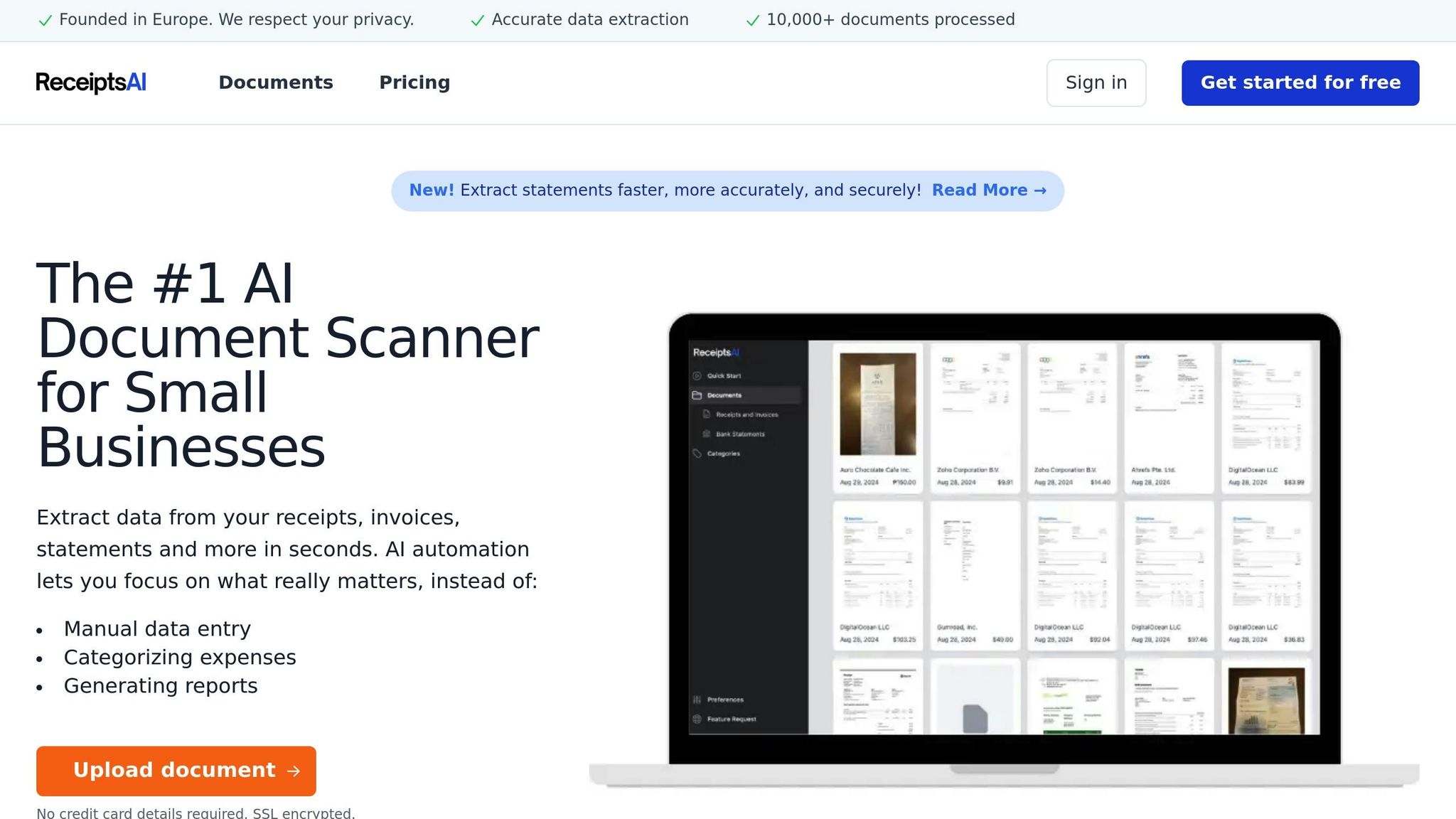

1. ReceiptsAI

ReceiptsAI stands out with its AI-powered categorization, achieving a 99% accuracy rate, comparable to Shoeboxed's benchmark. This makes it a strong choice for tackling audit readiness challenges, as highlighted earlier.

The platform offers three pricing options: Starter at $12/month for 100 pages, Premium at $29/month for 500 pages, and a free trial for up to 30 pages. Its advanced categorization system automatically organizes expenses into industry-specific categories, cutting down manual data entry time significantly. For context, this automation reduces per-receipt processing time from 20 minutes to under 2 minutes, aligning with industry standards.

Key features include:

- AI-powered contextual analysis with 99% OCR accuracy

- Support for multiple formats

- Customizable auto-categorization

- Compatibility with over 50 currencies

- AES-256 encryption for robust security

ReceiptsAI also integrates smoothly with popular accounting software, offering efficiency gains similar to those seen with tools like Zoho Expense, where users experience notable reductions in manual effort.

Designed for mobile expense management, ReceiptsAI combines accessibility with strong security and processing power, making it a reliable option for businesses on the go.

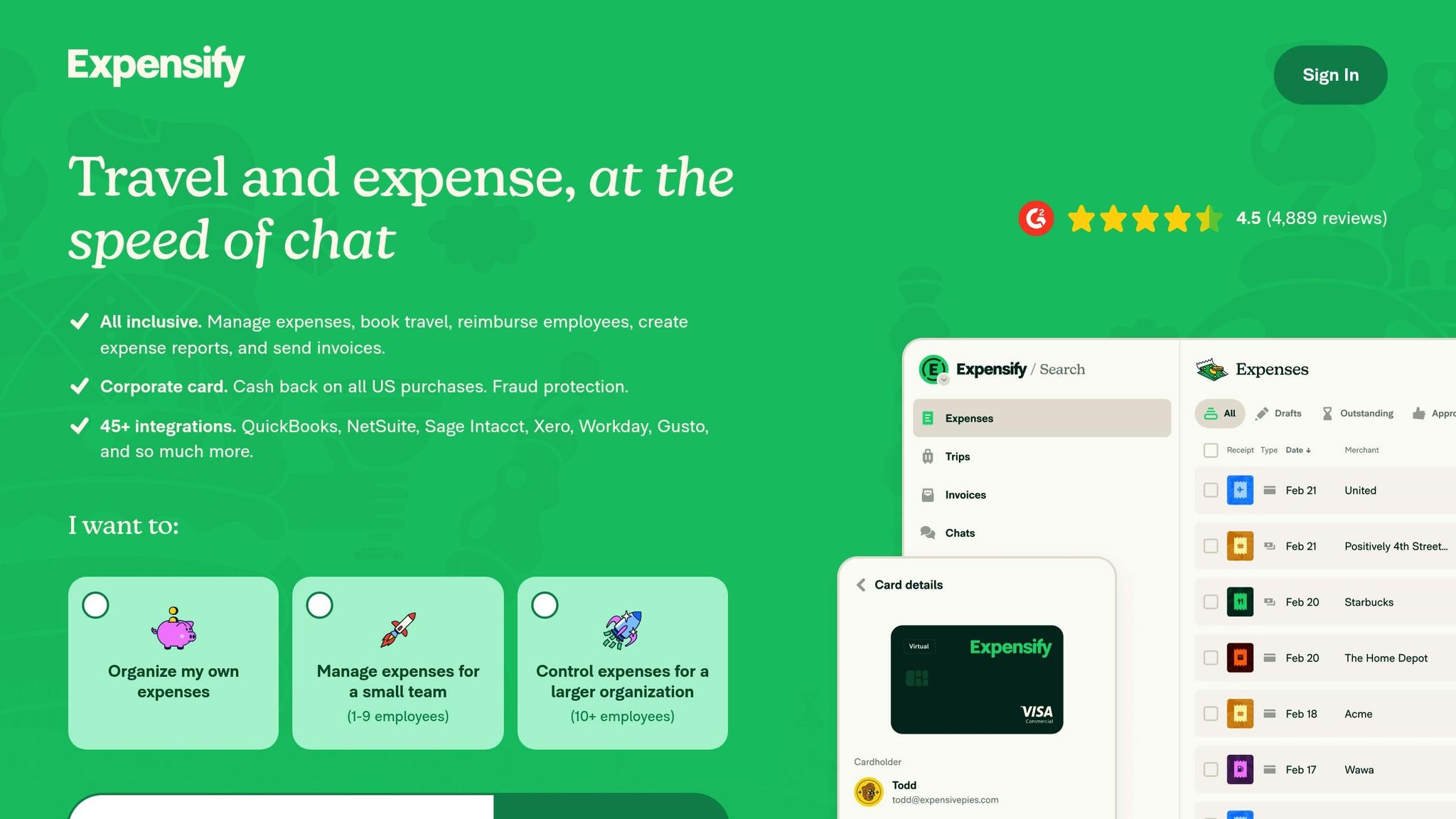

2. Expensify

Expensify continues to lead the way in receipt processing, boasting an impressive 99% accuracy rate, even with crumpled receipts, as of 2025. Its AI-powered system does more than just scan receipts - it flags policy violations automatically and learns from user corrections over time. This evolving AI builds on the OCR technology highlighted in our must-have features list.

Designed with mobile users in mind, Expensify pairs its SmartScan technology with policy enforcement across three pricing tiers:

- Collect: $5/user/month

- Control: $9/user/month

- Enterprise: Up to $36/user/month

Expensify’s seamless integrations have revolutionized expense management workflows. For example, AI automation has been shown to cut receipt processing time by 90%. One marketing team reduced their monthly expense reporting workload from 12 hours to just 45 minutes, thanks to SmartScan’s auto-categorization.

Key Features

- GPS-based automated mileage tracking

- AI-powered real-time expense auditing

- Tools for multi-user collaboration

- Corporate card management with customizable spending rules

- SOC 2-compliant data storage, meeting top security standards

While Expensify’s per-user pricing may be a hurdle for expanding teams, its mobile-friendly design addresses the 78% smartphone usage rate noted earlier. However, some web features remain exclusive to mobile, which could limit flexibility for certain users.

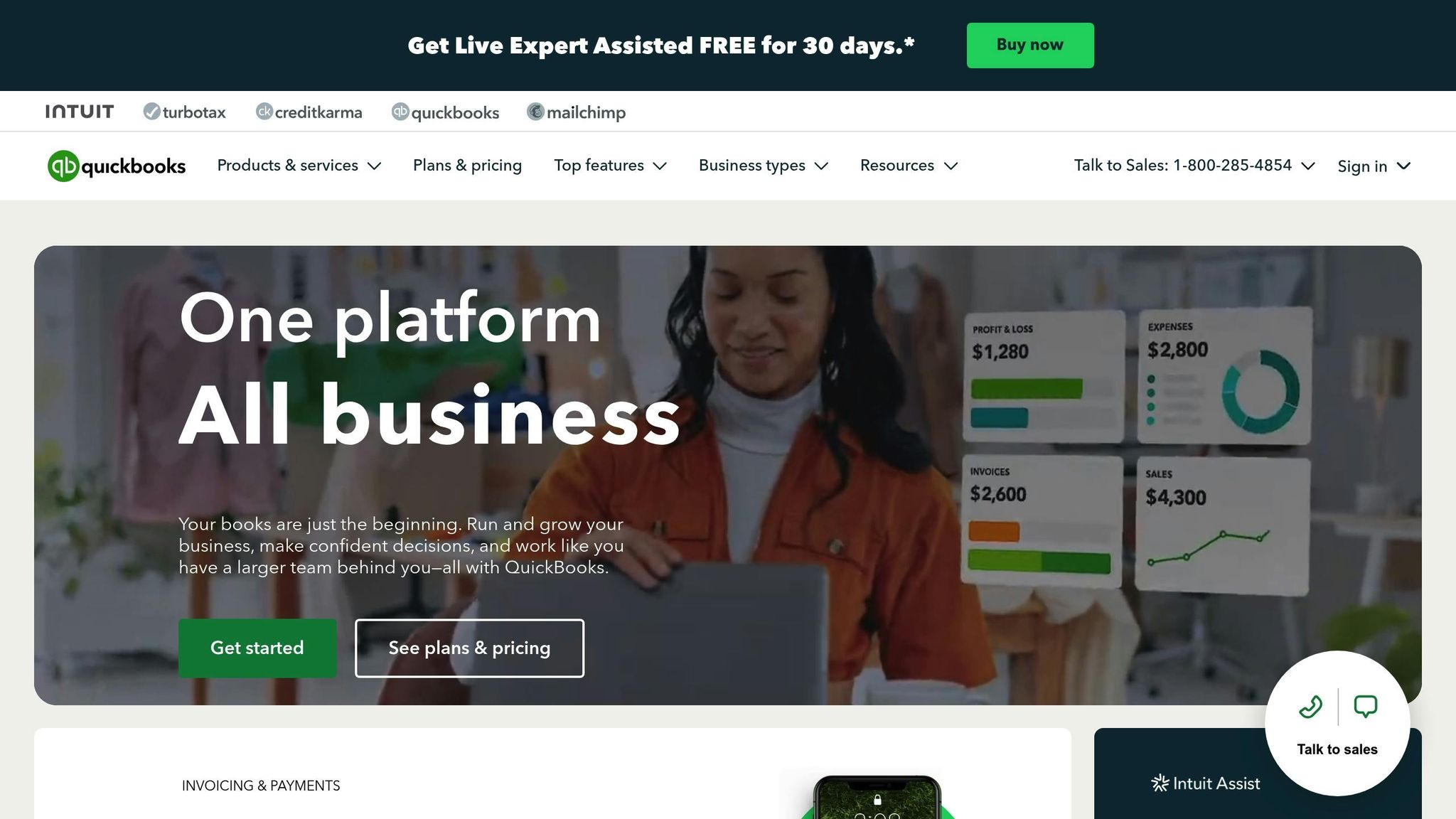

3. QuickBooks Self-Employed

QuickBooks Self-Employed is a tool designed specifically for freelancers and solopreneurs, offering features that build on the core OCR capabilities mentioned earlier. It's a practical choice for managing finances, taxes, and receipts, tailored to the needs of self-employed individuals.

The platform offers three pricing tiers: $15/month for the basic plan, $25/month with TurboTax integration, and $35/month for live tax support.

Key Features and Performance

This tool combines receipt scanning with tax-focused features. One standout function is its swipe-based expense separation, which simplifies tracking and categorizing expenses. It maintains an impressive 4.6/5 rating on Capterra.

Tax Integration Advantage

A major highlight of QuickBooks Self-Employed is its integration with TurboTax, which automates tasks like quarterly tax estimates and annual filings. This feature addresses a common challenge for freelancers. The Tax Bundle tier includes this integration, making it especially helpful during tax season.

Limitations to Consider

While ideal for solo users, its features can also serve microbusinesses transitioning from personal to business operations. However, businesses with more than three users will need to explore upgraded plans. Occasionally, minor issues with scanning accuracy occur, but these rarely interfere with the platform's overall functionality.

With tools like real-time profit and loss statements and receipt management, QuickBooks Self-Employed delivers a solid financial overview, helping small business owners make informed decisions.

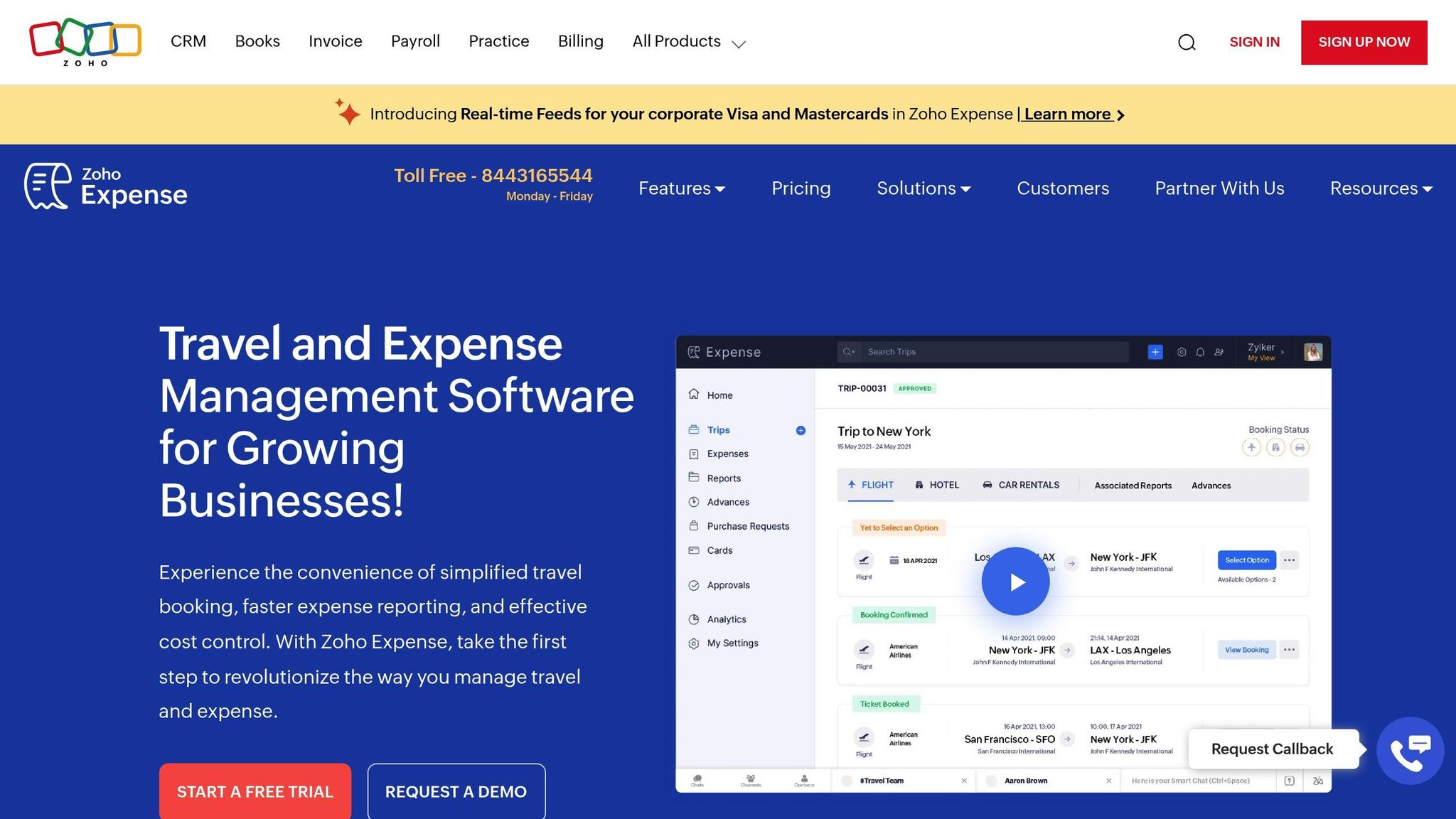

4. Zoho Expense

Zoho Expense takes receipt management to the next level with its multilingual capabilities and boasts over 90% accuracy in receipt scanning.

Advanced Language Support

The platform processes receipts in 14 languages and supports 160+ currencies.

Key Features

- QuickBooks Online nightly sync

- Xero transaction coding

- Real-time updates with Zoho Books

- Custom API and Zapier integration

- Seamless accounting integration through native Zoho Books sync

Pricing Options

Zoho Expense offers flexible plans designed to suit various needs:

- Free Tier: Up to 3 users, 20 scans per month

- Standard: $4/user/month – Unlimited scans and multi-currency support

- Premium: $7/user/month – Advanced workflows and full language support

Performance and Limitations

The platform achieves impressive accuracy in receipt scanning: 92% for restaurant receipts and 86% for parking receipts. These results align with the AI OCR standards discussed in Must-Have Features. However, the mobile app has some challenges, particularly when editing scanned receipt details on iOS devices.

User Feedback

Zoho Expense is rated 4.5/5 on Capterra, with users appreciating its user-friendly design and 87% auto-categorization accuracy.

"Ideal for SMBs already invested in Zoho ecosystem due to pre-built integrations saving implementation time" - Financial workflow analysts

5. Dext Prepare

Dext Prepare, previously known as Receipt Bank, uses advanced OCR technology to offer powerful document processing tools. It's particularly useful for managing and preserving audit trails, as discussed earlier.

Advanced Processing Features

Dext Prepare is built for handling complex documents, offering tools like:

- Bulk processing capabilities (introduced in 2024)

- Automated data categorization powered by machine learning

The bulk processing tool helps cut down manual work, aligning with the workload reduction benefits highlighted earlier.

Smart Organization Tools

The platform allows users to tag and search documents using metadata like dates, vendors, categories, and custom tags. These features make it easier to track expenses in real-time, as noted in our digital management overview.

Performance Insights

"Cut our manual entry time by 40%"

Dext Prepare excels at processing complicated receipts and invoices. However, some users mention a steeper learning curve compared to simpler receipt-scanning tools.

Security and Integration

With SOC2 compliance and bank-grade encryption, Dext Prepare ensures data security. It also integrates seamlessly with QuickBooks, Xero, and Sage, enabling automated ledger updates.

Plans begin at $20/month for 300 scans, with custom pricing available for unlimited usage.

6. Shoeboxed

Shoeboxed offers a practical solution for managing receipts by blending digital scanning with a mail-in service. Since its launch in 2007, it has processed over 1.5 billion receipts, making it a reliable choice for small businesses. This combination of technology and human verification ensures accuracy where automated systems might fall short.

Mail-in Processing

Shoeboxed's "Magic Envelope" service makes handling large volumes of receipts easy. Businesses can send up to 1,000 receipts each month using pre-paid envelopes, and Shoeboxed takes care of digitizing them professionally. This service is especially helpful for meeting audit requirements, as discussed earlier.

"Shoeboxed cut our monthly accounting admin from 40 hours to 5" - Verified Buyer on G2

Accurate Data Extraction

Shoeboxed pairs AI-powered OCR with human review to deliver highly accurate results. Key features include:

- 94% field accuracy across various receipt types, even achieving 91% success with faded thermal paper.

- Automatic extraction of details like merchant names, dates, amounts, and tax information.

Integration with Accounting Software

Shoeboxed integrates smoothly with popular accounting tools, making it easy to manage expenses:

- QuickBooks Online: Syncs in real-time.

- Xero: Automatically categorizes expenses.

- Wave Accounting: Enables direct data transfers.

Mobile Features

The Shoeboxed app for iOS and Android includes a "Batch Mode" scanning feature, allowing users to process up to 50 receipts in less than 3 minutes. It also includes GPS mileage tracking for travel-related expenses. These tools address the high smartphone usage rates highlighted in earlier sections.

Pricing

Shoeboxed offers three pricing tiers to fit different needs:

- Starter: $18/month for 50 scans.

- Professional: $36/month for 150 scans.

- Business: $54/month for 300 scans.

All plans include access to the mail-in service.

Tax Support

Shoeboxed simplifies tax preparation by automating Schedule C categorization, enabling users to complete filings up to 40% faster. This builds on the tax integration features seen in tools like QuickBooks Self-Employed.

7. Ramp

Ramp takes a mobile-first approach, combining advanced receipt scanning with automated audit trails. Its AI-driven OCR technology boasts a 98% accuracy rate, closely matching the industry benchmark of 99%+ accuracy mentioned earlier.

Advanced Receipt Processing

Ramp's receipt management system includes several standout features:

- Automatic Receipt Generation: Automatically creates receipts for transactions with vendors like Amazon and Lyft.

- Instant Spending Rule Checks: Cuts expense reporting time by 70% compared to traditional methods.

- Multi-currency Support: Handles receipts in various currencies.

Seamless Integrations

Ramp directly integrates with accounting tools like QuickBooks, Xero, NetSuite, and Sage Intacct, ensuring automated ledger updates without extra effort.

Mobile-Friendly Features

With one-tap scanning, automatic categorization, and encrypted cloud storage, Ramp simplifies expense tracking for users on the go.

"Flawless QuickBooks sync makes expense tracking effortless" - SmallBiz Owner review on Capterra

Flexible Pricing Options

Ramp offers a pricing structure that stands out from competitors who often charge per scan or user:

- Free Tier: Includes unlimited receipt scanning and basic expense management.

- Plus Plan: Costs $15 per user per month, offering advanced controls and customization options.

This model aligns with businesses looking for cost-efficient solutions.

Security and Compliance

Ramp prioritizes data protection with features like:

- SAML SSO as an optional security layer.

- Military-grade encryption for sensitive information.

To qualify, businesses need a minimum of $50,000 in a US business bank account, highlighting its role as a comprehensive financial platform.

App Features and Pricing Comparison

Here's a breakdown of how these apps stack up in terms of features, pricing, and usability.

Core Features Comparison

| Feature | ReceiptsAI | Expensify | QuickBooks | Zoho Expense | Dext Prepare | Shoeboxed | Ramp |

|---|---|---|---|---|---|---|---|

| Cloud Storage | Unlimited | Unlimited | Plan-based | 5GB-100GB | Unlimited | Plan-based | Unlimited |

| Multi-Currency | Yes | Yes | Yes | Yes | Yes | Limited | Yes |

| Real-time Policy Check | Yes | Yes | No | Yes | Yes | No | Yes |

| Physical Mail-in Service | No | No | No | No | Yes | Yes | No |

Pricing Structure

The pricing options for these apps cater to businesses of all sizes:

- Free Options: Zoho Expense and ReceiptsAI offer free tiers, ideal for small businesses. Ramp stands out by providing unlimited scanning at no cost.

- Paid Plans: For growing teams, paid plans vary. Expensify charges per user, while Shoeboxed offers high-volume scanning plans.

Integration Capabilities

When it comes to integrations, Dext Prepare and Ramp lead the pack with a wide range of third-party connections. QuickBooks shines within the Intuit ecosystem, making it a strong choice for users already invested in Intuit products.

User Experience and Mobile Support

All seven apps are available on both iOS and Android, ensuring seamless receipt capture on the go. Zoho Expense and Expensify are frequently praised for their intuitive design and ease of use.

Security and Compliance

Each app meets essential security standards, but there are additional perks worth noting:

- Secure cloud storage with regular backups is standard across all apps.

- Ramp offers extra enterprise-level security with optional SAML SSO.

These features make it easier for businesses to choose the right app based on their workflow needs, helping streamline processes while leveraging the AI-powered tools discussed earlier in this guide.

Conclusion

Based on feature comparisons and performance data, here’s how different solutions align with various business needs:

For startups on a tight budget, Ramp stands out with its unlimited free scanning, eliminating per-document fees. Zoho Expense is another great choice, offering a solid range of expense management tools.

Expanding businesses looking for advanced tools should consider Dext Prepare. At $15/month, it offers automated tax categorization and strong expense management features designed for growing teams.

If your focus is on digitizing paper records, Shoeboxed's Starter plan at $29/month offers a practical option. Its physical mail-in service makes it particularly useful for managing paper-heavy workflows.

For global operations, Zoho Expense is a top pick. It supports 14 languages and offers multi-currency capabilities, making it ideal for international businesses. On the other hand, freelancers and sole proprietors will appreciate QuickBooks Self-Employed’s tax estimation features and TurboTax integration.

Expensify takes the spotlight as the most versatile solution for 2025. Its SmartScan technology boasts 99% data extraction accuracy, and the AI-powered expense review system simplifies use for teams with varying levels of tech experience.

Most of these AI-powered tools come with free trials, allowing you to explore their features before committing.