How To Scan Receipts Into Excel

Learn how to efficiently scan and manage receipts in Excel using OCR technology to streamline financial tracking and reduce errors.

Scanning receipts into Excel can save you time, improve accuracy, and simplify financial management. Here's how to do it:

-

Why Go Digital?

Digital receipts save time and reduce errors. Tools with OCR (Optical Character Recognition) can achieve up to 97% accuracy in extracting data. Plus, digital systems are safer, more eco-friendly, and easier to organize. -

How It Works:

OCR technology extracts text from scanned images using methods like pattern matching or feature extraction. Modern tools combine OCR with AI to handle challenges like poor image quality, damaged receipts, or multiple languages. -

Best Tools:

Apps like Zoho Expense, Expensify, and ReceiptsAI let you scan receipts and export data directly to Excel. For higher accuracy, consider professional OCR software like ABBYY FineReader or DocuClipper. -

4 Steps to Scan Receipts into Excel:

- Prepare receipts (flatten, clean background, ensure good lighting).

- Use OCR tools to extract data.

- Export the data as a .csv file.

- Import into Excel and organize by columns (e.g., Date, Vendor, Amount).

-

Tips for Efficiency:

Scan receipts weekly, use cloud storage for backups, and regularly review data for accuracy.

| Tool | Best For | Starting Price |

|---|---|---|

| Zoho Expense | Small Teams | Free (up to 3 users) |

| Expensify | Business Travel | $4.99/month |

| ReceiptsAI | Small Businesses | $12/month |

| ABBYY FineReader | High Accuracy | Contact for pricing |

Switching to digital receipt scanning saves time, reduces costs, and makes financial tracking easier. Start today to streamline your workflow!

Scan Data into Excel effortlessly with these 2 tricks

Receipt Scanning Basics

Grasping the essentials of receipt scanning is crucial for smoothly transferring data into Excel.

Today’s receipt scanning relies on OCR (Optical Character Recognition) and AI to streamline expense tracking.

How OCR Technology Works

OCR technology involves pre-processing steps to prepare images for accurate text recognition:

- De-skewing: Straightens tilted images for better alignment.

- Despeckling: Cleans up digital noise and smooths text edges.

- Binarization: Converts images to black-and-white for clearer text recognition.

- Layout analysis: Identifies text blocks and data fields for better organization.

Once pre-processed, OCR applies one of two methods:

| Method | Process | Best For |

|---|---|---|

| Pattern Matching | Compares image pixels to stored templates | Clear, standard fonts |

| Feature Extraction | Breaks down characters into components like loops and lines | Various font styles and sizes |

Depending on the quality of the image and receipt condition, commercial OCR software can achieve accuracy rates of 81% to 99%. But even with these advancements, OCR still encounters challenges.

Common Issues in Receipt Scanning

Despite its advantages, receipt scanning isn't without hurdles. For instance, SparkReceipt reported that traditional expense tracking apps take around 10 minutes to process a receipt, whereas their AI-powered tool completes the task in just 5–10 seconds.

Here are some typical problems and their solutions:

| Problem | Impact | Solution |

|---|---|---|

| Poor Image Quality | Reduces data extraction accuracy | Use contrast adjustment and adaptive binarization |

| Damaged Receipts | Leads to missing or incomplete data | Apply AI-powered data extraction |

| Font Variations | Causes recognition errors | Leverage advanced feature extraction |

| Multiple Languages | Results in incorrect character interpretation | Enable multi-language OCR support |

Modern tools blend OCR with AI to overcome these challenges. For example, AI Receipt Tracker achieves an impressive 98% accuracy in automated field capture. Another case: BlueVine used Amazon Textract to process thousands of PPP loan applications, aiding in the preservation of over 400,000 jobs.

This combination of OCR and AI enhances receipt scanning by improving accuracy, understanding context, categorizing expenses, and ensuring seamless Excel integration.

Best Tools for Receipt Scanning

Choosing the right receipt scanning tool can make managing expenses in Excel much easier. Many modern tools use OCR (optical character recognition) and AI to pull details directly from receipts.

Mobile Apps for Receipt Scanning

Here’s a comparison of some of the top mobile apps for receipt scanning:

| App | Best For | Key Features | Starting Price |

|---|---|---|---|

| Zoho Expense | Small Teams | Multi-language support, Excel export | Free (up to 3 users) |

| Expensify | Business Travel | Quick reimbursements, receipt matching | $4.99/month |

| Wave | Freelancers | Automated categorization, accounting integration, OCR scanning* | $8/month |

| Veryfi | Accuracy Focus | Advanced OCR, real-time processing | $19.99/user/month |

*Note: Wave’s OCR scanning is part of its receipts plan.

"The most cost-effective and well-rounded receipt scanning and expense app we tried" – Forbes Advisor

If you deal with a higher volume of receipts, you might want to consider professional scanners or advanced OCR software, which are described below.

Professional Scanners and OCR Software

For businesses handling large numbers of receipts, dedicated OCR software provides better precision and specialized features:

-

ABBYY FineReader

Offers 99.8% accuracy for machine-printed text and 97% for handwritten text. It supports over 190 languages and allows Excel exports. -

DocuClipper

Trained on over 1,000,000 bank statements, achieving 99.5% accuracy for data extraction. -

Valid8 Financial

Provides up to 99% extraction accuracy with full data verification and seamless Excel integration.

For small businesses, tools like ReceiptsAI are designed to simplify bookkeeping with tailored features.

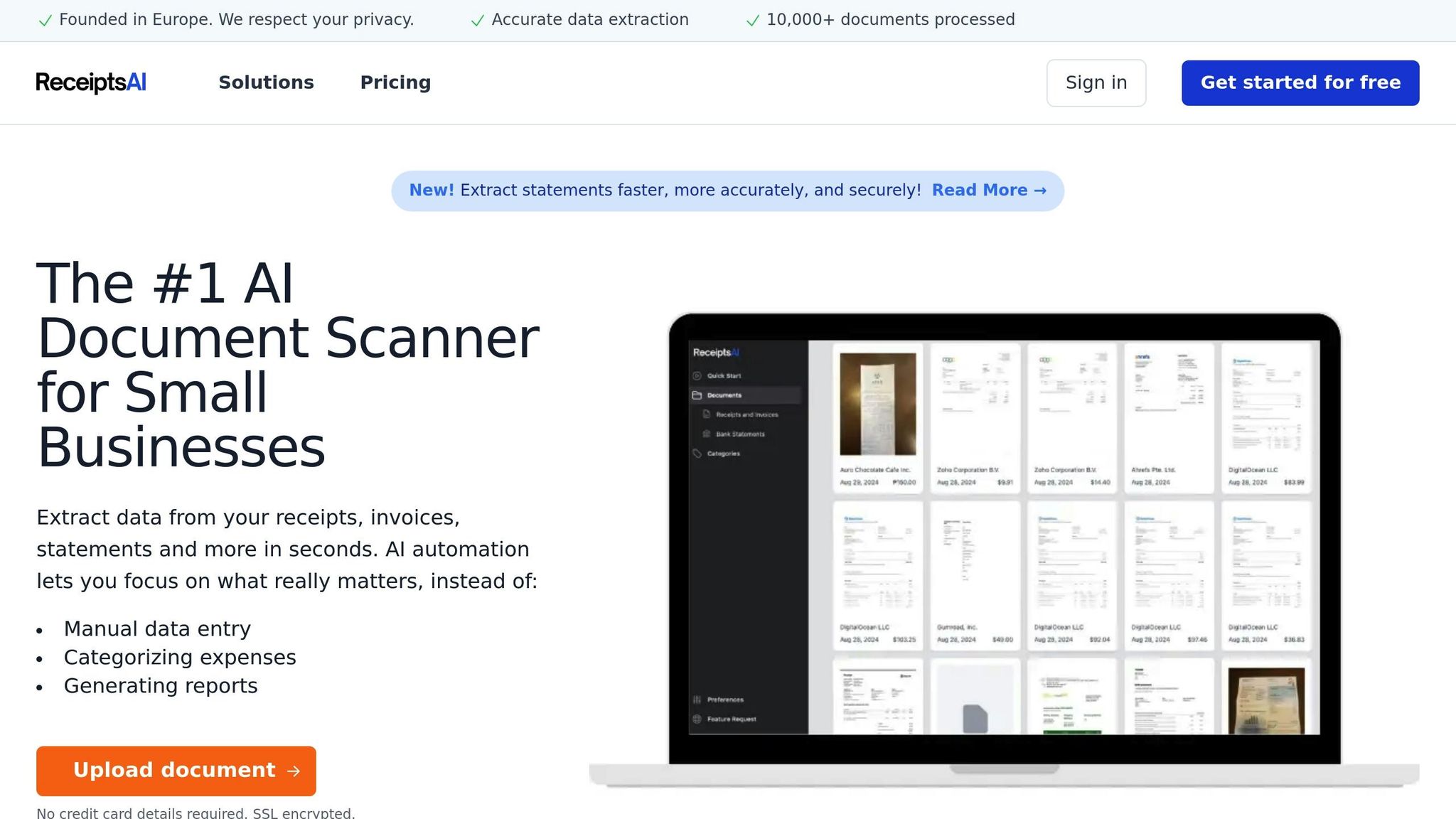

ReceiptsAI: Features and Plans

ReceiptsAI uses AI to automate data extraction from receipts, invoices, and bank statements. It also allows direct exports to Excel, making it ideal for small businesses managing finances through spreadsheets.

| Plan Name | Price | Features | Page Limit |

|---|---|---|---|

| Free Tier | $0/month | Basic Support, 30 pages | 30 pages/month |

| Starter | $12/month | Excel Export, Reports, 100 pages | 100 pages/month |

| Premium | $29/month | Advanced Features, Premium Support, 500 pages | 500 pages/month |

ReceiptsAI stands out for its smart categorization and bank-level security, ensuring your financial data is both well-organized and secure. It’s particularly useful for businesses that rely heavily on Excel for financial tracking.

4 Steps to Scan Receipts into Excel

Receipt Preparation Tips

Before scanning, make sure your receipts are in good condition. Smooth out any wrinkles and remove staples or paper clips to avoid scanning issues. If a receipt is torn, use clear tape to repair it so the text remains legible.

For flatbed scanners, place receipts facedown and ensure they don’t overlap. If you’re using a smartphone, lay the receipts on a plain, solid-colored surface and ensure the area is well-lit.

| Preparation Step | Why It Matters |

|---|---|

| Flatten receipts | Reduces shadows and improves text recognition |

| Remove fasteners | Prevents damage and ensures smooth scanning |

| Repair tears | Keeps data readable for OCR tools |

| Clean background | Enhances contrast for better text detection |

| Proper lighting | Boosts image quality and OCR performance |

Using OCR to Get Receipt Data

OCR (Optical Character Recognition) technology transforms the text on receipts into digital, editable data. Many apps combine OCR with AI to recognize receipt-specific details like dates, vendors, and amounts.

To stay organized, use a consistent naming system for your files, such as YYYYMMDD_VendorName_Amount. Tools like DocuClipper go a step further by extracting detailed information - line items, quantities, amounts, taxes, and invoice numbers - and pairing it with the original PDF for easy verification.

Once your receipt data is processed, it’s ready to be imported into Excel.

Moving Data from OCR to Excel

After confirming the OCR results are accurate, follow these steps to transfer the data into Excel:

- Export the OCR data as a .csv file.

- Open a new Excel workbook.

- Import the .csv file using Excel’s import feature.

- Organize the data by formatting columns for:

- Date

- Vendor name

- Item description

- Amount

- Tax

- Category

Apps with AI capabilities can automatically categorize your expenses and export them directly into Excel, saving you time and reducing the chance of manual errors.

Once the data is in Excel, review it carefully for any OCR mistakes or formatting problems. Use Excel’s built-in tools like sorting, filtering, and conditional formatting to quickly spot and fix any issues.

Make Receipt Scanning More Efficient

Set Up a Weekly Scanning Schedule

Having a regular schedule for receipt scanning can save time and keep things organized. On average, employees spend about 8 minutes per receipt, so sticking to a routine is key.

Try setting aside a specific time each week to process receipts. Ideally, scan receipts as soon as you get them to avoid a backlog. This keeps your records up-to-date and reduces the chances of losing or damaging receipts.

| Time Period | Task | Purpose |

|---|---|---|

| Daily | Scan new receipts quickly | Prevent buildup |

| Weekly | Verify data in Excel | Spot errors early |

| Monthly | Review and categorize receipts | Stay organized and accurate |

| Quarterly | Backup and check archives | Protect your data |

Once you’ve established a scanning routine, focus on storing and organizing your receipts digitally for easy access.

Digital Receipt Storage Methods

Switching to cloud storage can significantly cut down on receipt errors. Automated tools, for example, have an error rate of just 1.3%, compared to 17.7% for paper-based systems.

To make the most of digital storage:

- Set up a dedicated email for e-receipts to streamline processing.

- Use consistent file names for easier searches.

- Regularly back up your files using cloud services or external drives.

Fix Common Scanning Problems

Beyond scheduling and storage, solving common scanning issues improves accuracy. Focus on these adjustments to enhance your results:

- Scan at a resolution of at least 300 dpi for better text recognition.

- Ensure good lighting to avoid shadows or glare.

- Use pre-processing tools to align text correctly.

- Keep your OCR software updated regularly.

- Track performance metrics like accuracy and precision.

- Set up a system for reporting and fixing errors.

Companies using digital tools report a 190% boost in employee satisfaction compared to those relying on traditional methods. By addressing these common challenges, you’ll ensure cleaner data for Excel and smoother financial tracking.

Conclusion: Next Steps for Receipt Management

By leveraging the scanning methods and tools discussed earlier, digitizing receipts in Excel can help reduce administrative tasks and improve compliance. Businesses that adopt digital processes with OCR and cloud storage have reported cutting administrative costs by 30% while achieving better compliance records.

Key Takeaways

Effective receipt management relies on the right tools and consistent habits. For example, ReceiptsAI offers automated data extraction starting at $12/month for up to 100 pages, making it a practical choice for small businesses and freelancers.

| Action | Benefit | Implementation Tip |

|---|---|---|

| Digital Processing | Reduces data loss | Use OCR-enabled receipt apps |

| Weekly Review | Identifies errors | Compare entries with statements |

| Cloud Storage | Ensures secure access | Set up automatic backups |

| Regular Audits | Supports tax compliance | Conduct quarterly reviews |

These steps align perfectly with the tools and processes outlined earlier.

"I used to spend hours manually entering receipts into spreadsheets. Now I use ReceiptsAI to do it automatically. It's a lifesaver!" – Norma W., President at Real Estate Company

Best Practices:

- Categorize receipts immediately using pre-set categories.

- Conduct monthly reviews to track spending trends.

- Store backups in the cloud to meet legal retention requirements.

- Regularly check data accuracy with systematic reviews.