How to Automate Receipt Management: A Guide for Freelancers

Learn how freelancers can automate receipt management to save time, increase accuracy, and maximize tax deductions with the right tools.

Automating receipt management can save freelancers up to 90% of their bookkeeping time and boost accuracy to 99%. Tools like Expensify, ReceiptsAI, and QuickBooks simplify expense tracking, reduce errors, and help claim up to $5,000 more in tax deductions annually. Here's what you need to know:

- Time Savings: Reduce manual receipt processing from hours to minutes.

- Accuracy: Automated tools cut error rates from 4% to less than 1%.

- Features to Look For: Advanced OCR, cloud storage, mobile apps, and accounting integration.

- Top Tools: Expensify ($4.99/month), ReceiptsAI ($12/month), Dext ($20/month), QuickBooks ($25/month).

| Tool | Starting Price | OCR Accuracy | Monthly Doc Limit | Mobile App | AI Categorization |

|---|---|---|---|---|---|

| Expensify | $4.99/month | 98% | Unlimited | Yes | Advanced |

| ReceiptsAI | $12/month | 95% | 100 | Yes | Advanced |

| Dext | $20/month | 97% | 300 | Yes | Basic |

| QuickBooks | $25/month | 99% | Unlimited | Yes | Advanced |

Switch to automation today to save time, reduce stress, and focus on growing your freelance business.

Best Receipt Scanner Apps For Small Businesses

Step 1: Review Your Current Receipt System

Take a close look at how you currently handle receipts. Research shows that 81% of freelancers struggle with receipt management, spending about 10 hours each month on manual tasks. Pinpointing these pain points will help you see where automation can save time and effort.

Common Receipt Management Challenges

Freelancers often deal with these issues:

- Misplaced receipts, which can lead to missed tax deductions

- Manual data entry, which has a 4% error rate

- Mixing personal and business expenses

- Delayed receipt processing that disrupts billing timelines

Define Clear Automation Goals

Set specific, measurable goals to improve your process:

-

Save Time

Track how long you spend managing receipts. Automation can reduce this time by up to 75% within three months. -

Boost Accuracy

Manual systems typically have a 4% error rate, while automated tools bring that down to 0.5%. Aim to improve categorization accuracy, process receipts within 24 hours, and reduce back-and-forth with your accountant. -

Integrate Systems

Make sure your automated system works with your accounting software. Your goals could include generating expense reports in under five minutes, accurately capturing most receipts, and completing setup within a month.

These goals will guide you toward a faster, more reliable receipt management system.

Step 2: Select Receipt Management Software

Once you've outlined your requirements, it's time to pick software that uses AI-powered OCR technology for receipt management. Look for tools that offer 95–99% accuracy in data extraction. Choosing the right software ensures your expense tracking is efficient and error-free.

Key Features to Look For

When comparing receipt management tools, focus on these must-have features:

- Advanced OCR: Opt for tools that accurately extract receipt details, reducing the need for manual entry.

- Cloud Storage: Keep receipts secure with encrypted storage and easy access anytime.

- Integration with Accounting Platforms: Tools that connect with systems like QuickBooks or Xero can reduce bookkeeping errors by up to 65%.

- Mobile App: Essential for capturing receipts on the go, especially with features like automatic edge detection.

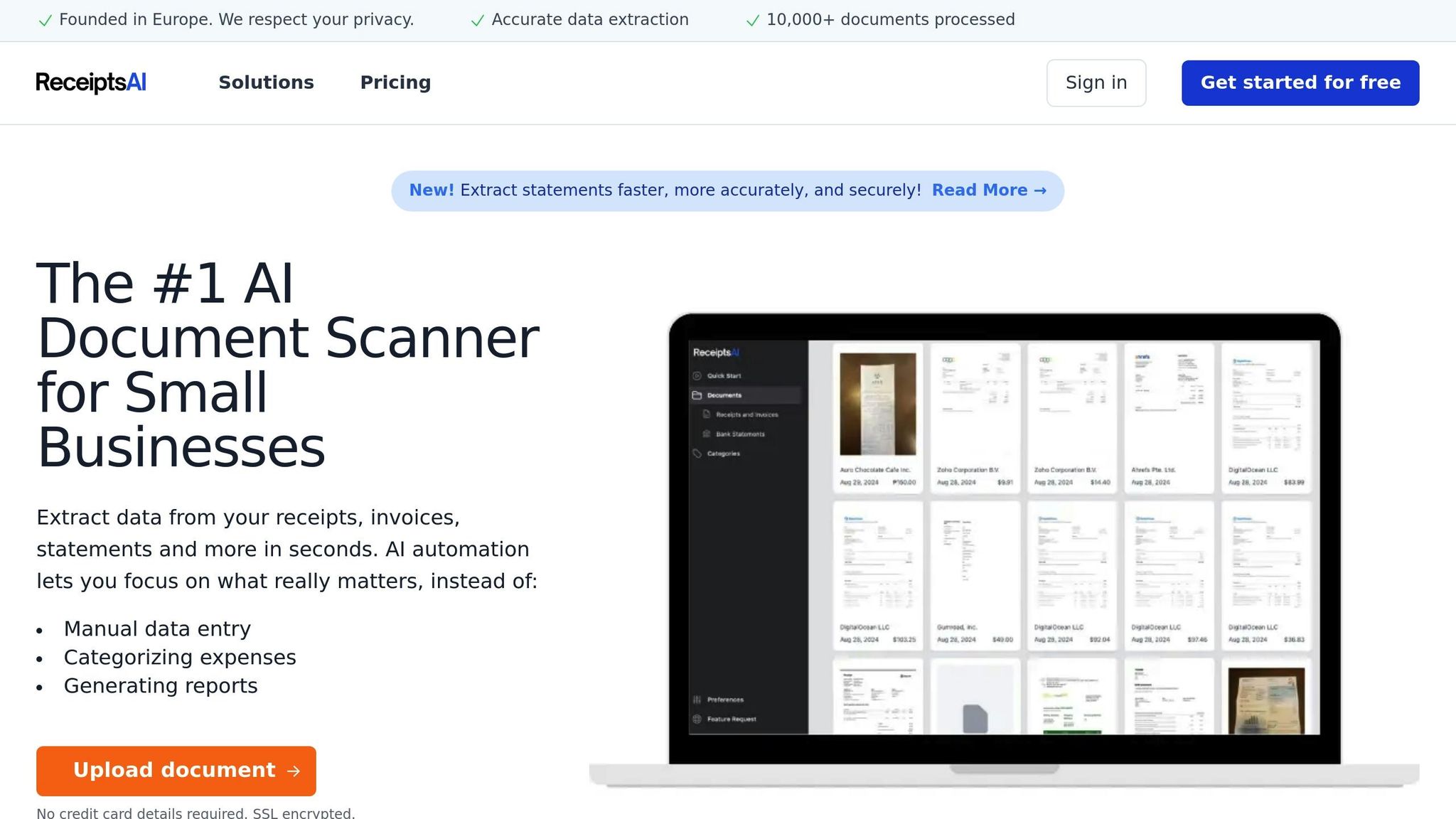

Comparing ReceiptsAI and Other Tools

| Feature | ReceiptsAI | Expensify | Dext | QuickBooks |

|---|---|---|---|---|

| Starting Price | $12/month | $4.99/month | $20/month | $25/month |

| OCR Accuracy | 95% | 98% | 97% | 99% |

| Monthly Doc Limit | 100 | Unlimited | 300 | Unlimited |

| Mobile App | Yes | Yes | Yes | Yes |

| AI Categorization | Advanced | Advanced | Basic | Advanced |

Each option brings something different to the table. Expensify stands out for its affordability and high user ratings, with plans starting at $4.99/month. Dext is ideal for handling complex data extraction tasks at $20/month. QuickBooks offers seamless accounting integration for $25/month, while ReceiptsAI provides a balanced feature set at $12/month, making it a great choice for freelancers.

In Q2 2024, freelance graphic designer Emily Chen cut her bookkeeping time from 12 hours to just 2.5 hours per month by using Expensify. Over three months, she processed 387 receipts with 99.2% accuracy in categorization and data extraction. This efficiency freed up time for two new clients, boosting her quarterly income by $7,800.

Source: Expensify Customer Success Stories, 2024

The best tool for you will depend on your specific needs and budget. Many platforms offer free trials - take advantage of them to explore the interface and features before committing to a subscription. Once you've made your choice, you can move on to setting up your system to maximize automation.

Step 3: Set Up Your Receipt System

Once you've chosen your software, it's time to implement automation. This will help reduce manual data entry while keeping your expense tracking accurate.

Organize and Digitize Receipts

Start by converting old receipts into digital files and creating a system for managing new ones. Use OCR (Optical Character Recognition) tools to scan receipts in batches. For best results, ensure proper lighting and keep documents flat during scanning. Many receipt apps can automatically detect edges and adjust the image for clarity.

To stay organized, use a consistent naming format for your files, like YYYYMMDD_VendorName_Amount.pdf. You can also set up email rules to automatically forward digital receipts to your expense management tool, simplifying the process even further.

Automate Receipt Processing

Set up automated rules to categorize receipts efficiently. These rules can use vendor names, amounts, or specific keywords to sort expenses. Here's an example of how you might configure these rules:

| Rule Type | Example | Purpose |

|---|---|---|

| Vendor-Based | "Uber" → Travel | Automatically sorts by vendor |

| Amount-Based | "<$20" → Supplies | Categorizes small purchases |

| Keyword-Based | "AWS" → Software | Groups expenses by service type |

| Client-Specific | "Client123" → Project A | Tracks expenses by client |

To make this work seamlessly, align your categories with the structure in your accounting software. This setup can cut down manual categorization by up to 90%. Even with automation, it's important to periodically review the system to ensure everything runs smoothly.

Maintain Your System

Keep your receipt system running effectively with regular reviews. Here's a simple maintenance schedule:

- Daily: Use your mobile app to scan new receipts immediately.

- Weekly: Check for any uncategorized items and address them.

- Monthly: Reconcile your records with bank statements.

- Quarterly: Update automation rules to account for new vendors or changes in your business.

To ensure everything stays secure and accessible, enable automatic software updates and back up your data regularly. Tools like ReceiptsAI offer cloud-based storage with strong security measures, giving you peace of mind while keeping your financial records organized.

Step 4: Use Advanced Receipt Features

Process International Receipts

Handling international receipts can be tricky due to currency and language differences. Modern receipt management tools simplify this process with features that handle these challenges automatically. By enabling multi-currency support in your receipt software, you can efficiently process receipts from different countries.

Tools like ReceiptsAI use OCR technology to extract data from receipts in various languages. Here's how you can set up automations for international receipts:

| Feature | Purpose | Benefit |

|---|---|---|

| Currency Conversion | Converts currencies based on transaction dates | Saves time on manual calculations |

| Multi-language OCR | Extracts receipt data in any language | Avoids manual translation and data entry |

| Tax Rules | Adjusts tax rates based on receipt origin | Ensures compliance with local tax laws |

Take freelance graphic designer Maria Rodriguez, for example. In 2024, she used Expensify to automate her international receipt processing. By leveraging automated currency conversion for receipts from different countries, she cut her bookkeeping time from 8 hours to 2 hours each month. Plus, she increased her tax deductions by $1,200 thanks to more accurate reporting.

Once your international receipts are automated, you can take it a step further by applying AI to manage vendor tracking and expense categorization.

Use AI for Vendor Tracking

AI simplifies tracking recurring expenses and improves how expenses are categorized. After setting up international receipt automation, focusing on vendor tracking can further streamline your expense management process.

Standardize Your Vendor Database: Create a database with consistent vendor names and common variations. As you make corrections, the AI learns and improves its accuracy over time.

Set Up Smart Rules: Use automated rules to ensure consistent tracking of expenses:

| Rule Type | Example | Automation Result |

|---|---|---|

| Vendor Recognition | "Amazon Web Services" → "AWS" | Standardizes vendor names |

| Project Allocation | "Adobe" → "Design Tools" | Links expenses to specific business areas |

Regularly review AI categorizations to catch errors and fine-tune the system. Over time, machine learning algorithms adapt to new vendors and changing spending habits, making your expense management more efficient. This approach minimizes manual effort and ensures your entire receipt management system works seamlessly.

Step 5: Fix Common Receipt Problems to Support Your Automated System

Once your receipt process is automated, it's time to tackle common problems to make the system run even smoother.

Separate Personal and Business Expenses

A whopping 73% of freelancers find it tough to keep personal and business expenses apart. Simplify this by:

- Using different payment methods for personal and business spending.

- Setting up auto-categorization based on vendor names.

- Scheduling regular reviews to double-check accuracy.

This ensures your expenses stay organized and easy to manage. But that's not all - scanning quality plays a big role in keeping your data accurate.

Improve Receipt Scan Quality

Poor-quality scans can mess up data extraction. Many modern receipt systems use advanced OCR (Optical Character Recognition) technology to handle this, reaching up to 99% accuracy even with tricky receipts. Tools like Dext use image enhancement and multi-angle processing to extract information from hard-to-read receipts.

Here’s how to boost your OCR results:

- Take multiple photos of damaged receipts for better clarity.

- Use the auto-enhancement features in your software.

Technologies like HyperVerge's OCR are also great for minimizing manual data entry by reliably automating recognition tasks. If problems continue, manual verification can act as a backup.

Conclusion: Results of Receipt Automation

Automating receipt management helps freelancers save time, increase productivity, and keep their financial records accurate.

With automation, manual receipt processing drops by 80–90%, cutting weekly tasks from 4–5 hours to just 30–45 minutes. These systems also achieve 99.5% accuracy, trimming tax prep time by 60% and easing tax-related stress by 40%.

Take Sarah, for example. After using ReceiptsAI, she experienced:

- Weekly admin time reduced: From 5 hours to just 30 minutes

- Annual time saved: 234 hours

- Boost in billable hours: Up by 15%

- Extra revenue generated: $12,000 annually

Additionally, 81% of small businesses report better expense tracking accuracy through automation. This improvement supports smarter pricing strategies and healthier cash flow. With the receipt automation market forecasted to hit $4.2 billion by 2026 [13], more freelancers are turning to these tools for streamlined, audit-ready financial management.