Digital vs Paper Receipts: What Small Businesses Need to Know

Explore the key differences between digital and paper receipts to determine which is best for your small business needs.

Choosing between digital and paper receipts can impact your business's costs, efficiency, and record-keeping. Digital receipts save money, reduce manual work, and offer easy access through cloud storage. Paper receipts, while traditional, are still useful in areas with limited internet or for customers who prefer physical proof of purchase.

Quick Comparison

| Aspect | Digital Receipts | Paper Receipts |

|---|---|---|

| Cost | Saves on paper and printing | Requires ongoing supply costs |

| Processing Time | Faster with automation | Slower, manual entry needed |

| Storage | Cloud-based, easy to access | Needs physical space |

| Accessibility | Available anywhere with internet | Limited to physical location |

| Environmental Impact | Reduces waste | Creates paper waste |

Digital receipts are ideal for businesses with high transaction volumes or limited storage, while paper receipts work for areas with low connectivity or customers preferring physical copies. A hybrid approach can combine the best of both.

Paper vs. Digital Receipts

Digital Receipts: Pros and Cons

Digital receipt systems have reshaped how small businesses manage transaction records. They bring several advantages but also come with a few challenges.

Benefits of Digital Receipts

Digital receipts streamline processes like data entry and receipt management, saving money on paper, printing, and storage. They also cut down on time spent on manual tasks.

According to Retail Dive, nearly 90% of consumers now prefer digital receipts over paper ones. This shift aligns with the growing reliance on digital tools in business operations. Here’s how they help:

| Benefit | Business Impact |

|---|---|

| Real-time Expense Tracking | Provides instant insights into cash flow and spending |

| Reduces Manual Input | Lowers the risk of human error |

| Cloud Storage | Allows access from anywhere and ensures better recovery options |

| Cuts Paper Waste | Helps reduce environmental impact |

| Customer Analytics | Offers deeper understanding of buying habits |

While the benefits are clear, there are also some hurdles to consider.

Limitations of Digital Receipts

To make digital receipt systems work effectively, small businesses need to invest in:

- Secure backup systems to prevent data loss

- Regular updates and system maintenance

- Training employees on how to use the technology

- Strong cybersecurity measures to protect sensitive information

These challenges highlight the importance of having a reliable digital platform in place. Knowing these limitations can help businesses choose the right tools.

Digital Receipt Features Overview

| Feature | Function | Business Benefit |

|---|---|---|

| OCR Technology | Extracts text from images | Removes the need for manual data entry |

| Cloud Integration | Syncs with accounting tools | Simplifies bookkeeping |

| Search Capability | Quick receipt lookup | Saves time during audits |

| Custom Categories | Organizes expenses | Makes financial planning easier |

| Automated Backup | Regularly saves data | Adds an extra layer of security |

Over time, adopting digital receipt systems can lead to better efficiency and stronger financial management.

Paper Receipts: Pros and Cons

Paper receipts, being non-digital, offer a dependable option during power outages or when internet connectivity is limited. They also provide instant proof of purchase. Despite the growing shift toward digital alternatives, paper receipts continue to fulfill specific business needs.

Benefits of Paper Receipts

Paper receipts bring certain advantages, especially in situations where digital systems may not be practical. They are particularly useful for:

- Businesses in remote areas where connectivity is unreliable

- Customers who prefer having a physical record

- Scenarios requiring quick, on-the-spot verification

A study by Green America found that 42% of consumers still prefer paper receipts, showing their continued importance in many transactions.

Limitations of Paper Receipts

While paper receipts have their uses, they also come with challenges that can impact business operations. For example, storing them requires physical space, and manual processing is time-consuming and prone to errors. Here are some common drawbacks:

| Challenge | Impact on Business |

|---|---|

| Physical Storage | Takes up space and needs organized filing systems |

| Manual Processing | Slower than digital methods, increasing labor costs |

| Supply Costs | Involves ongoing expenses for paper and printing supplies |

| Environmental Concerns | Adds to waste and uses chemicals in printing |

| Fading Over Time | Risk of losing important information, such as for taxes |

Paper Receipt Features Overview

| Feature | Function | Business Impact |

|---|---|---|

| Physical Proof | Tangible record of transactions | Useful for immediate verification |

| Familiar Format | Easy to use and widely accepted | Requires minimal training for employees |

| Manual Filing | Relies on physical organization | Can lead to higher storage and labor costs |

Although paper receipts still serve a purpose in certain settings, their limitations are pushing many businesses to explore more efficient digital alternatives.

How to Switch to Digital Receipts

Switching from paper to digital receipts is easy with tools that handle scanning, sorting, and compliance. Below, we’ll look at OCR tools, platforms like ReceiptsAI, and key steps for staying compliant.

OCR Tools for Receipt Processing

OCR (Optical Character Recognition) technology converts paper receipts into searchable digital files, cutting down on manual entry. It can pull out important details such as:

| Information Type | Details Extracted |

|---|---|

| Transaction Data | Date, time, and total amount |

| Vendor Details | Business name, address, and contact info |

| Item Details | Descriptions, prices, and quantities |

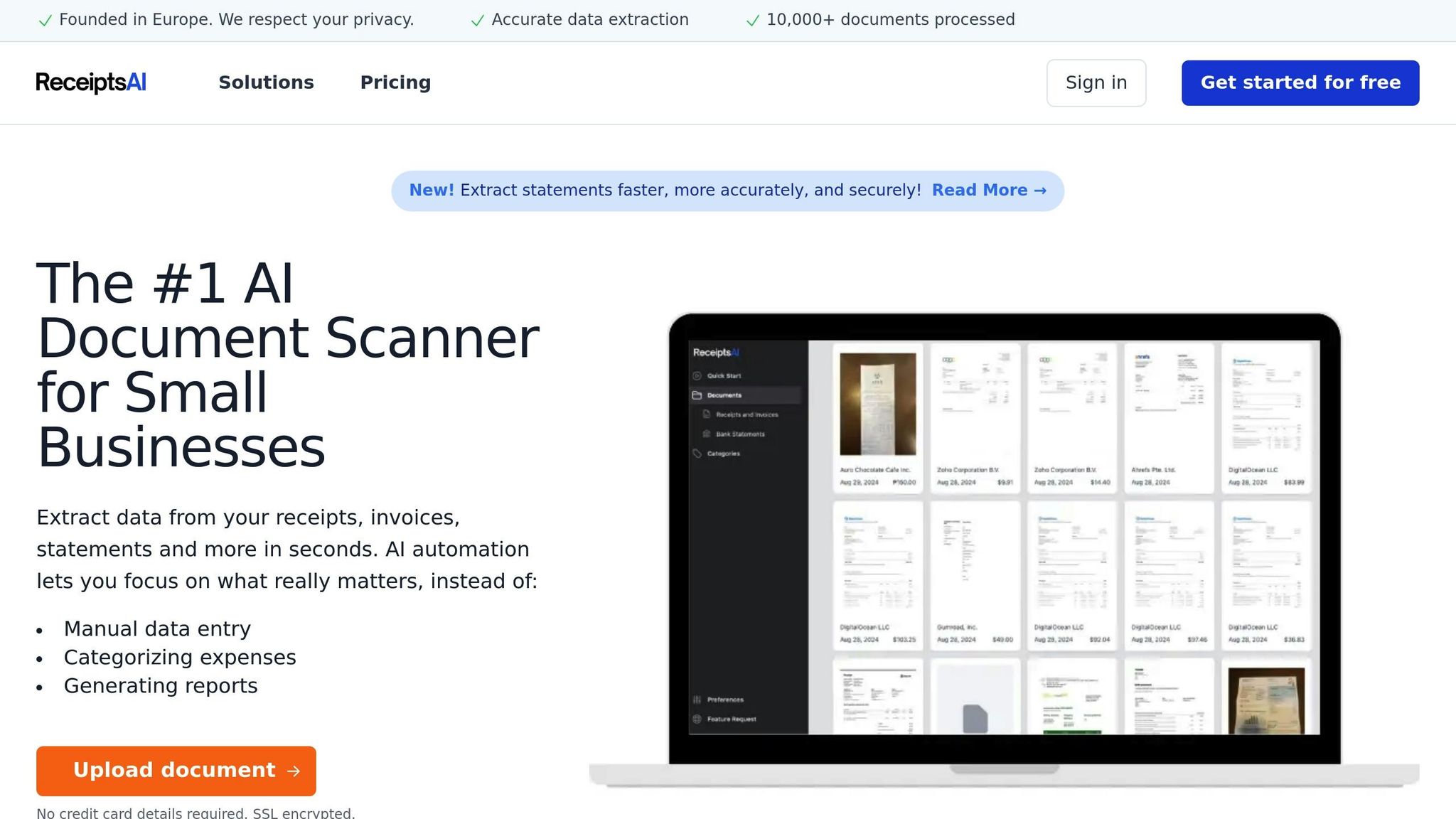

Using ReceiptsAI for Receipt Management

ReceiptsAI simplifies receipt management with features like:

| Feature | Benefit |

|---|---|

| Smart Categorization | Automatically organizes expenses |

| Cloud Storage | Secure, easy access from anywhere |

| Multi-Format Support | Works with PDFs, images, and more |

| Export Options | Quick export to Excel, CSV, or PDF |

Plans start at $12/month for the Starter tier, which allows up to 100 pages per month - perfect for small businesses taking their first step toward digital records.

Tax Compliance Steps for Digital Receipts

To ensure your digital receipts meet tax requirements, follow these steps:

- Capture all details: Include transaction date, total amount, vendor info, and item descriptions.

- Use secure cloud storage: Pick a system with reliable backups to avoid data loss.

- Organize systematically: Create a clear naming and filing system for easy access during audits or tax filing.

The IRS accepts digital receipts as long as they are clear and include all necessary details. Keeping organized records and an accessible audit trail is critical for smooth compliance.

Choosing Between Digital and Paper Receipts

Deciding between digital and paper receipts depends on your business's specific needs. Here's a breakdown of key factors to help you choose the right approach.

Decision Guide and Key Considerations

Take a look at how digital and paper receipts align with different business requirements:

| Business Factor | Digital Receipts Work Best For | Paper Receipts Work Best For |

|---|---|---|

| Transaction Volume | High-volume businesses (100+ monthly) | Low-volume operations (< 50 monthly) |

| Tech Infrastructure | Businesses with existing digital tools | Traditional retail with basic POS |

| Storage Space | Limited physical storage | Ample storage space available |

| Budget | Focus on long-term cost savings | Minimal upfront investment |

For many businesses, a hybrid approach can be a smart transition strategy. This involves digitizing high-volume transactions while continuing to use paper receipts in specific cases, such as:

- Cash transactions in areas with poor internet connectivity.

- Customers who prefer paper receipts (particularly older demographics).

- Situations where immediate physical proof of purchase is required.

Implementation Strategy

To get started, consider using ReceiptsAI's $12/month Starter plan to digitize high-volume transactions. Monitor key metrics like processing time, storage expenses, employee efficiency, and customer satisfaction to evaluate the system's impact.

Security Considerations

When adopting digital receipts, prioritize data protection by:

- Backing up data regularly.

- Using encrypted storage solutions.

- Implementing strict access controls.

- Ensuring compliance with tax regulations.

The IRS accepts digital receipts as valid documentation as long as they are clear and include all necessary transaction details. No matter your choice, make sure your records are complete, accessible, and secure.

FAQs

Does the IRS accept digital copies of receipts?

Yes, the IRS accepts digital receipts as long as they include key details like the date, amount, vendor name, and a clear description of the goods or services purchased.

Make sure to store your digital receipts in a secure and well-organized system that allows quick access if needed for an audit. Using a system with automated organization and secure backups can help you stay prepared.

Can I keep digital copies of receipts?

Yes, you’re allowed to keep digital copies of your receipts. The IRS advises holding onto these records for at least three years from the date you file your tax return.

Here are some tips for managing digital receipts:

- Use secure storage with regular backups.

- Ensure the copies are clear and easy to read.

- Follow consistent naming conventions for files.

- Utilize tools that automate categorization.

For added convenience and security, you might want to explore receipt management software. Many of these tools offer encrypted storage and automatic organization, making bookkeeping much easier.